The Optimal Times for Buying and Selling Coins on eBay October 17 2013

As with any website, eBay has periods of heavy and light traffic. In the early evening, when most Americans are at home after work, you might expect that lots of people are using eBay. And when more people are using eBay, more people are bidding on each item. But go onto eBay in the middle of the night, and odds are that you’ll be competing with fewer bidders. But what exactly are the most ideal times (and days of the week) for buyers to face the least amount of competition? And when can sellers expect their items to be bidded on by the highest number of people?

eBay helpfully provides the option to search through previously completed listings, so you can see how much a specific item has sold for in the past. A few months ago, I decided to start to record the prices and times of completed listings of four types of coins, in an effort to determine the most optimal days and times for buyers to buy and sellers to sell their coins.

I picked four coins that are relatively standardized—that is, there isn’t a huge amount of variation in quality or value between individual specimens. Large price variations would skew my data. I also had to avoid coins that derived much of their value from precious metals (i.e. coins such as double eagles, bullion coins, common-date silver, etc) as bullion price fluctuations would throw off the data. The final criteria was that the coins had to be sold frequently on eBay. I could track the price of mint state 1909-S VDB cents, but it would take me a very long time to accumulate enough data points for my study to be statistically meaningful.

The four coins I eventually settled on were: circulated Columbian Exposition half dollars, PCGS/NGC-graded MS-64 1881-S Morgan dollars, PCGS/NGC MS-65 1945-S Mercury dimes, and 1890-1900 circulated British crowns (featuring Queen Victoria).

When collecting the data, I ran a quick eye over the sold listings and avoided coins with exceptional qualities that would raise the selling price significantly (such as “+”, “*”, or CAC slab designations, rainbow toning, etc). I also restricted myself to auction listings (as opposed to Buy It Now) with at least two bids. My reasoning was that BIN listings and completed auctions with only one bid represent a single person's perception of how much a coin is worth, as opposed to the evaluations of multiple bidders. The more people that bid on any given item, the closer we can get to the true market valuation. If one person foolishly bids on a coin that’s priced double book value, then recording that value would throw my data off. After collecting the data, I discarded all outlier prices* so that unusually fierce bidding wars or massive bargains wouldn’t inflate or deflate my numbers.

The Results

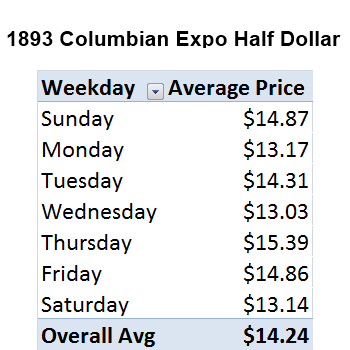

Now the data wasn't exactly as definitive as I would have hoped, but some interesting trends still emerged. Thursday was the highest sell price day for 3 of the 4 coins, while Wednesday and Sunday had the lowest sell prices on average. From this rudimentary analysis, it appears that Thursday might be a good day for sellers to set their auction end-dates, while eBay buyers should keep an eye out for bargains on Wednesdays and Sundays.

The Time vs Price graph (all times Pacific Standard Time) contains the data points from all four coins, normalized by the mean. Normalizing the data allowed me to include all the points on a single combined graph as opposed to four individual graphs. The line through the graph is a line of best-fit, which means that half of the data points are above it and the other half are below it. The best-fit line provides an idea of the general trend of prices over the course of a single day—as you can see, it gradually increases from early morning up into the evening. It appears that the vast majority of eBay auctions end at around 6:00 pm PST (9 Eastern). There aren’t enough data points from listings later at night or early in the morning to really make any definite conclusions but it appears that the ideal time for sellers to set their auctions to end is somewhere around 5 to 7pm PST. The best time to look for coins to buy is, as you might expect, earlier in the day or very late at night (probably because most people are either sleeping or at work).

Obviously there are some limitations to this analysis, the largest of which is a simple paucity of data. The prices I collected represent only a few months worth of data, on a very small number of coins. I personally plan to continue to collect data for these coins and to start collecting data on several more as well. If anybody else is interesting in this sort of thing, I would highly encourage you to begin collecting data on specific coins you’re interested in buying or selling. I'd be happy to share my own data as well. Who knows what interesting trends might appear?

*For outliers, I discarded all values more than 2.5 standard deviations above or below the mean.

Written by Max Breitenbach

Written by Max Breitenbach